Digital Enterprise Journal (DEJ)’s research study, Strategies of Leading Organizations in Adopting Observability, provides actionable recommendations to end-users on how to achieve the success level of top performing organizations (TPO – top 20% of research participants based on performance). However, the study is vendor agnostic and DEJ just published a research report, Top 10 Vendors for Enabling Leading Organizations in Observability, to identify leading vendors for enabling practices of TPOs. Vendors’ are evaluated based on the alignment of key user requirements and challenges (as reported in the market study) with their core strengths and capabilities.

This DEJ’s Research note provides an overview of the key findings that report.

Observability vendor landscape is not as crowded as it looks

DEJ’s study shows that 64% of organizations have deployed, or are looking to deploy Observability capabilities. However, 48% of organizations reported that market confusion and an inability to differentiate Observability solutions as the key obstacle for deployment. Observability is one of the hottest technology concepts and one would assume that the market for these solutions is very crowded. From a messaging perspective, it does look like there are close to a hundred vendors competing in this space. However, the study shows that when it comes to enabling organizations to address their key challenges, meet their top goals and overcome main obstacles for Observability, the list of vendors actually becomes fairly short.

The top 10 vendors for enabling Observability identified in this report are ChaosSearch, Chronosphere, Coralogix, Cribl, Datadog, Dynatrace, LogicMonitor, Mezmo (formerly LogDNA), Observe and StackState.

Also, the research shows that there is no clear leader in this market and many of the vendors that go to market by providing “Observability” solutions do not even compete against each other. Ten technology vendors highlighted in this report have established their leadership by effectively enabling Observability adoption by addressing key challenges.

Observability data management and analysis at scale

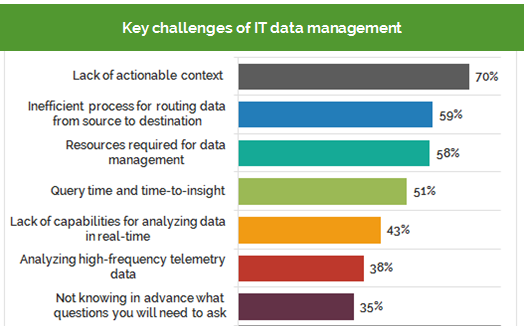

The research shows a broad range of challenges that organizations are looking to address by adopting Observability. The #1 challenge reported is a lack of capabilities for data management and analysis at scale. The report reveals a number of underlining issues that are causing this to be the top challenge and key capabilities that TPOs are using to address it.

Some of the most effective capabilities in this area deployed by TPOs are provided by leading vendors identified in DEJ’s report. The report shows that TPOs are:

- 51% more likely to have the ability to create contextual insights across data silos, tools and technologies

- 6 times more likely to have an ability to route Observability data where it has the most value (also known as an Observability pipeline)

- 2 times more likely to be democratizing benefits of Observability and enabling access to different job roles

- 61% more likely to have capabilities for real-time analysis of streaming data

12.4 times increase in the amount of IT data since adopting a cloud native approach

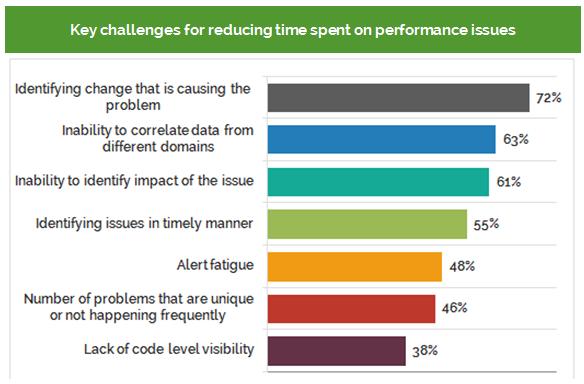

Time and resources spent on resolving performance issues

TPOs are, on average, reporting MTTR of 43 minutes per incident as compared to 172 minutes (2.9 hours) for all others. These organizations are also nearly twice as likely to prevent performance incidents before they impact end-users. As a result, TPOs, developers and engineers are able to spend 2.6 times more time on high-value tasks.

The report found that time spent on resolving performance issue is the #2 challenge for Observability. The figure above shows that there are a number of issues behind this challenge. The report identified several capabilities that are very effective in addressing these issues which are being provided by leading Observability vendors and deployed by TPOs. The TPOs are:

- 5 times more likely to have the ability to unify a root cause and impact analysis

- 3 times more likely to have a collaboration platform that is based on context driven automation

- 69% more likely to have centralized coverage of an entire system

Sixty-three percent of organizations reported eliminating “blind spots” on a digital delivery chain as their main goal for adopting Observability. Also, 72% of organizations reported that identifying change which is causing the problem as a key challenge. Deploying capabilities listed above allows TPOs to reduce inefficiencies, dynamically manage change and, as a result, free up more resources for innovation and growth.

Business context

DEJ’s study revealed that there is no true Observability without the business context. However, 59% of organizations reported a lack of business context of Observability solutions as a key challenge. TPOs are more effective in addressing this issue by deploying capabilities provided by leading vendors in enabling Observability. The report shows that TPOs are:

- 9 times more likely to have the ability to capture every change in service topology and correlate it with business performance

- 81% more likely to have the ability to use Observability data to prioritize business decisions

- 71% more likely to have the ability to correlate Observability and business data

Cost of Observability

The report identified the cost of data processing and storage as the #1 obstacle for adopting Observability. The research shows that organizations are losing, on average, $5.1 million annually due to a lack of balance between cost/resources and performance of managing digital services. TPOs are leveraging capabilities provided by leading vendors to overcome this challenge. Some of the TPO capabilities that are very effective in this area are mentioned above, such as real-time analysis of streaming data and Observability pipeline. In addition, TPOs are:

- 6 times more likely to have an ability to collect and analyze data at its source (Edge Observability)

- 77% more likely to have an ability to separate analysis of data from indexing and storage

Summary

In addition to identifying 10 leading vendors in enabling Observability, the report also shows a lot of innovation that is taking place on the vendor side. Some emerging capabilities that are not necessarily in the spotlight when analyzing Observability landscapes are having a major impact on performance. The report also shows that there is a need for more innovation, especially surrounding the areas of providing business context, providing and enabling differentiating digital experiences, monitoring and Observability data management.

The full study can be accessed on DEJ’s website through this link. Complementary derivative reports can be downloaded on the websites of companies that own distribution rights.