DEJ just published a report titled, Top 20 Vendors for Managing IT Performance in 2022. The report is derived from DEJ’s state of the market study, 24 Key Areas Shaping IT Performance Markets in 2022, that included insights from more than 3,300 hundred organizations. One interesting fact about this newly published report is that it includes only eight vendors that were profiled in a similar publication in 2020.

This Research Note analyzes key changes in user requirements that led to a major overhaul of the vendor landscape for IT performance solutions.

1 – Increase in the importance of technology-as-a-competitive-advantage (TaCA)

DEJ’s research shows a 3.7 times increase in the number of organizations that are forced to innovate faster to stay competitive. Additionally, the study shows that 68% of organizations that adopted a cloud native approach improved their ability to create better customer experiences. That resulted in the inclusion of vendors, such as Chronosphere and Sentry, with ServiceNow further strengthening its position through the acquisition of Lightstep, as these companies provide strong capabilities for managing cloud native environments and are helping customers to innovate faster while delivering differentiating user experiences.

2 – War for talent

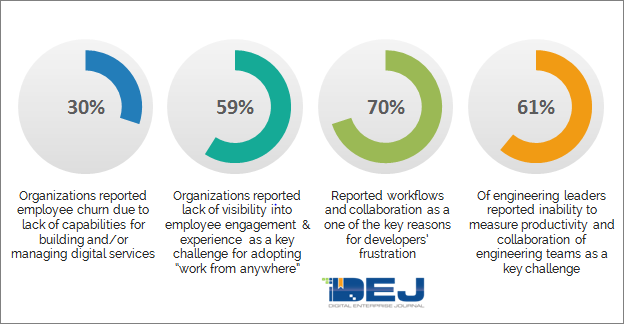

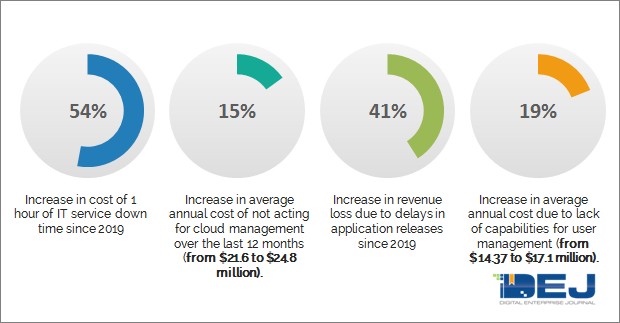

The study shows that organizations are losing, on average, $13.74 million due to lack of talent for modernization. The research also reveals $2.282 million average annual loss in employee turnover due to lack of visibility in employee experience. As it is becoming more difficult to find and retain talent, challenges such as employee churn due to lack of capabilities for building and/or managing digital services, developers’ frustration due to workflows and collaboration processes, lack of visibility in employee experience and engagement and the inability to measure productivity and collaboration of engineering teams are not helping that cause. That led to inclusion on vendors such as 1E, Jellyfish and Sentry, with companies such as Nexthink, PagerDuty and Riverbed (listed as Aternity in the 2020 report) further strengthening their positions.

3 – The need for a true Observability and a new definition of visibility

Forty-five percent of organizations reported that they experienced the need to monitor and analyze new areas and domains over the last 3 years. Additionally, 46% of organizations reported that the business context is a key requirement for their visibility approach. That led to the addition of Kentik, LogicMonitor and OpsRamp in this year’s report, with vendors like Catchpoint, Datadog, Dynatrace and ScienceLogic further strengthening their position.

Also, 69% of business executives reported “enabling technology as a competitive advantage” as their key goal for Observability, while 41% of organizations reported that cost of Observability outweighs benefits. That led to the inclusion of Observability leaders, such as Chronosphere, Coralogix, Cribl and Mezmo (formerly Log DNA), that not only enable organizations to achieve top business goals by adopting Observability, but also help reduce cost of Observability data processing and storage and increase the value of data.

4 – Optimization and visibility into inefficiencies

DEJ’s 2021 study, The Total Business Impact of IT Performance, revealed that reducing inefficiencies is the #1 business goal for organizations. However, the new report shows that 68% of organizations do not have visibility into how their IT resources are being used. As a result, the research shows a $5.1 million average annual loss due to a lack of balance between cost/resources and performance of managing digital services. Vendors such as Cribl, Jellyfish, NS1 and ServiceNow are providing strong capabilities for addressing this challenge.

5 – Working with open source

The report shows a 37% increase in the number of organizations building their IT performance strategies around open source over the last 2 years. Also, 57% of organizations reported that capabilities of open source solutions significantly improved over the last 2 years. Still, it is reported that 61% of do-it-yourself (DIY) initiatives for managing IT performance fail within 6-12 months.

Organizations are understanding that they can’t solely rely on open source technologies to manage IT performance, but the study shows a 33% increase in the importance of “maximizing value of open source” as a selection criteria for commercial solutions over the last 18 months. This led to inclusion of vendors such as Aiven, Chronosphere, Coralogix and Mezmo that provide strong capabilities for getting the most out of open source solutions.

6 – Data management and analytics

All of the top 20 vendors provide strong capabilities for putting data in an actionable context and enabling data-driven decisions. However, the study shows that user expectations for data management and analytics at scale are increasing, as 38% of organizations identified it as a key area for improvement to be creating business value from technology deployments. Vendors like Aiven, Coralogix, Cribl, Kentik and Mezmo provide very strong capabilities in this area.

7 – Three areas defining the future of managing IT performance

One of the key requirements for inclusion in this report was ranking “Strong” or higher in three major areas that are shaping IT performance markets in 2022: 1) Impact on business outcomes; 2) Enabling unique customer experiences; and 3) Everything in the business context.

Twenty vendors profiled in this report are: 1E, Aiven, Catchpoint, Chronosphere, Coralogix, Cribl, Datadog, Dynatrace, Jellyfish, Kentik, LogicMonitor, Mezmo (formerly LogDNA), Nexthink, NS1, OpsRamp, PagerDuty, Riverbed, ScienceLogic, Sentry and ServiceNow.

The report can be accessed on DEJ’s website through this link. You can also access individual evaluation profiles for vendors that enabled a complimentary access: Catchpoint, Mezmo, Nexthink, OpsRamp and Riverbed