As Digital Enterprise Journal wrote earlier in the year, analytics capabilities were reported as the key driver for new adoption of IT performance monitoring solutions. Since then, we have had a number of conversations with technology vendors from different areas of IT performance (network and application performance, testing, business service management, Cloud management, log analysis, ITOA, etc.) and there were two common teams for most of these briefings: 1) most of them have Analytics or Intelligence very high in their positioning; 2) their definitions of Analytics are significantly different.

The bottom line is that every IT performance monitoring solutions include some kind of analytics, but some questions presented were: what capabilities for processing data are included, what types of data are being analyzed and how, what are the sources of this data, how and when it is presented, how it is being stored, managed and searched, etc.

Our research discovered at least 14 themes around Analytics in IT performance, with each of them creating different submarkets and addressing different use cases. Some of these themes are:

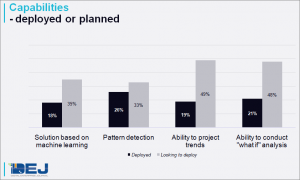

1 – Advanced and predictive analytics. This is the core area of Analytics and the key driver for future deployments. Figure 1 shows that advanced analytics capabilities across different areas have the highest growth potential.

2 – Machine learning. DEJ’s research shows a 45% increase in the number of organizations looking to deploy machine learning capabilities for IT performance since 2014. Also, Figure 1 lists machine learning capabilities as one of the top investment areas in IT performance for user organizations in the next 12 months. The market for this type of capability is fairly diverse and includes a wide range of solutions.

3 – Wire data. 46% of organizations in DEJ’s network performance monitoring (NPM) survey are looking to acquire capabilities to extract business data from the network. Vendors providing this type of capability include ExtraHop Networks, Corvil, INETCO and Dynatrace.

4 – Log analytics. 34% of organizations are deploying analytics capabilities to deal with large amounts of log data. Vendors providing this type of capability include Splunk, Loggly and Sumo Logic.

5 – Business and Finance view. Inability to provide business level reporting is one of the key pain points for IT performance for 37% of organizations. Correlata is a good example of a vendor with strong capabilities in this area. Additionally, 39% of organizations are looking to use analytics to optimize IT cost while improving performance. Apptio is an example of a vendor that is specializing in this area.

6 – Big Data architectures. 24% percent of organizations are looking to deploy or build Big Data infrastructure that is tailored to IT performance (as opposed to using one of the generic solutions for data management).

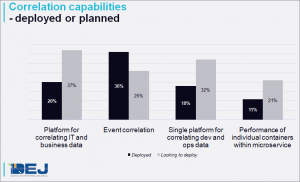

7 – Correlation. 49% of organizations reported a lack of correlation between system elements as one of their key challenges. Figure 2 shows some capabilities organizations are most likely to deploy. Examples of vendors providing solutions in some of key use cases include Moogsoft, Datadog, VictorOps and Instana.

8 – Automation and alerts. 55% of organizations are looking to improve accuracy, timeliness and relevance of their alerting and notification capabilities. Some of the vendors providing strong capabilities in this area include BigPanda and Loom Systems.

9 – Application transaction data. 41% of business users are looking to gain actionable insight into data from application transaction monitoring. Nastel is a vendor with strong capabilities in this area.

10 – Search and query. Close to a third of organizations reported that the speed of search and query is one of their top goals for managing network data.

11 – Visualizations. 38% of organizations reported that capabilities of user interface (UI) is one of the key challenges for making IT performance data more actionable.

12 – End-user. 46% of organizations reported that their need for processing and analyzing customer data in real-time has increased over the last 12 months. Examples of organizations providing analytics capabilities in this area include Nexthink (end-point) and Catchpoint (Web).

13 – Mobile. 45% of organizations are looking to gain visibility into the impact of performance on usage patterns for mobile users.

14 – Community learning. 41% of organizations are looking to deploy capabilities that will enable them to analyze not just their own performance data, but data from other user organizations that are using the same solution.

It is clear that Analytics and Data Management are making a major impact on every aspect of IT performance. From the themes mentioned above, it is also clear that all of the solutions that are leading with analytics are not created equal. Categorizing areas of IT performance analytics and defining submarkets is a difficult task because there is a lot of overlap between these 14 themes and already too much noise in a market that is rapidly changing.

Using ITOA as a term to define at least some of the areas of Analytics in IT performance was a good attempt, but it did not reduce confusion in the market. It actually created more perplexity for two reasons: 1) ITOA is not a technology class, but a concept that includes, as it is defined now, a broad range of capabilities and approaches; 2) the term is so hot and so generic that it is being used in marketing messaging of vendors that have very little in common and never compete against each other.

DEJ’s research on digital transformation shows that the goal of 71% of organizations is to make IT more strategic in 2017. The same research shows that 78% of these organizations see IT Operations Analytics as a technology that can help them achieve this goal. There is a major opportunity for IT performance monitoring vendors around analytics capabilities and going into 2017 they should focus on the following areas:

- Building new and innovative analytics capabilities, not just moving Analytics higher up in their presentations.

- Vendors that are providing pure play analytics capabilities (many of them are using ITOA to define what they do) will need to find a way to communicate that they are not just another monitoring tool and find the right balance between differentiating themselves and not looking like a niche player.

- Vendors cannot get too excited about opportunities around Analytics and forget what business they are in when crafting their messaging. There is a huge difference between vendors for whom Analytics is whole business and those that have it as a feature of a broader monitoring toolset. That’s a good place to start to reduce some of the confusion.

Vendors have to be very careful in their messaging and find an elegant way to spell out what exactly they can do for their customers from the Analytics perspective. If they don’t, Analytics in IT performance will become one of those words that mean completely different things to different people (as it should) and its perceived value will diminish in the eyes of the customer.