In 2010, I published an article for TRAC Research about key trends in network performance monitoring (NPM) market. The key themes were a potential convergence of NPM and APM, the need for more proactive approach and making network data more actionable. NetQoS was still around, Extrahop was a startup that most of other vendors never heard of, Riverbed was still trying to figure out what to do with technology that they acquired from Mazu and most of the innovation in this market was coming from the marketing side. In short, even it’s been only six years since this was written, looking at the data from this year’s research, it seems like it was centuries ago.

We followed up this article with a survey in 2013 and on September 26 Digital Enterprise Journal will be publishing a NPM market study that will include both this year’s results, but also trending data. Here is a brief summary of some of the key themes of the study:

Concerns

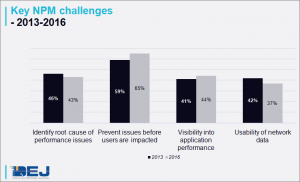

Old KPIs are not improving and new KPIs are not being introduced yet. Figure 1 shows that when it comes to addressing key performance issues organizations experienced either incremental improvements or even a decline in some areas over the last three years. In 2013, 64% reported that network is playing more strategic role in their organization. However, very few organizations introduced metrics to track how the network impacts their organization on a strategic level.

Lack of confidence in NPM solutions for monitoring Cloud performance and quality of user experience. Fifty seven percent of organizations reported that NPM tools are not providing enough visibility into cloud performance. Additionally, only 28% are using NPM tools as their user experience monitoring solution of choice.

Perplexity

Digital Economy vs. Digital Transformation. As more organizations are starting the process of digital transformation, many NPM vendors are adjusting their positioning and adopting digital transformation as one of the key use cases they claim they are addressing. Digital transformation is an internal process and even though it is a lucrative opportunity for NPM vendors not all organizations are doing it. Digital economy is a business reality that impacts every organization and, therefore, changes their requirements for managing network performance. That is what NPM vendors should be focused on.

Network data. This has become one of the key themes in the market, but views of user organizations significantly vary when it comes to purposes, value, usability, management issues and most importantly types of data that they are looking for.

Security and performance. Security capabilities and messaging are a smart way for NPM vendors to get access to new budgets and in some cases it could be an easier sale than taking a performance angle. However, taking the path of less resistance could be a risky strategy as vendors are entering a market with different dynamics while leaving job with customers that are looking for performance unfinished.

Opportunities

Ease of purchase and deployment. Deploying NPM as software as a service (SaaS) is one of the key capabilities that organizations are looking to adopt. Also, transparency of the purchasing process and investing in a package of capabilities that is aligned with their true needs is one of the items that is becoming increasingly important in their selection process. Adjusting delivery, pricing and packaging models represents a major opportunity for NPM vendors, especially in underserved parts of the market.

New use cases. Our 2013 research listed VoIP/UC, mobility and virtualization management as one of the key use cases where NPM solutions are needed. Even though these IT initiatives are still having a major impact on network performance, we are seeing use cases, both business and IT, which are becoming increasingly important. On the IT side, organizations are reporting SD-WAN, new types of collaboration platforms and WiFi as areas that are driving new adoption of NPM while on the business side themes such as managing small branch offices and digital transformation are becoming increasingly important.

Network playing more strategic role. Even though this is a great opportunity, it will take a good amount of innovation to capitalize on that. Some key areas where users are looking for improvement from vendors include:

- Flexibility to adapt to changes

- Advanced analytics

- Scalability

- True automation of NPM functions

- Reducing complexity

- Understanding new dynamics of buyers and IT teams

Outlook

The NPM market has always been fragmented, but now it is becoming even more heterogeneous. Traditional differentiation between vendors was more based on underlining approaches for monitoring as flow analysis or packet recording. Even though that is still the case, new use cases, ability to support different technologies, deployment methods and ability to provide innovative capabilities for digital economy are defining new micro-markets with NPM. Digital economy brings a new set of network performance challenges and it is changing a playing field in the NPM market. That represents a massive opportunity for new market leaders to emerge and redefine the role that NPM plays in the digital enterprise.

User organizations already gave NPM marching orders how do benefit from dynamics of digital economy and new management requirements. There is a gaping hole in the NPM market for a clear leader and a vendor that is capable to execute on these new requirements has a chance to take this market by storm.