Earlier this year, I had a small anniversary of being an industry analyst for ten years. It was a good time to reflect on what it is that I really like and dislike about my role and the industry I am in.

Constantly learning, truly covering markets and vendors and becoming an expert, being in a position to interview and survey thousands of knowledgeable people, having data to back up your statements, and knowing that you influence the market are some of the best things about being an industry analyst. However, spending ten years in this role and seeing how markets and the economy are changing got me thinking where this industry is headed and what can be done better or different.

Shortcomings of analyst model

Project and campaign based approach about publishing. Every major study is managed as a project, which means it has a start and end date and a bunch of milestones for specific components of the research process (survey creation, launch and completion, cut off dates for product inclusion, etc.). This helps analysts get better organized and set expectations in the market, which is great. But your audience has a goal for that research which is ongoing, and even though a snapshot of research findings in time does help, their goals don’t have start and end dates.

Lengthy publishing cycles. If you want to do it right (surveys, interviews, vetting the topic, fact check, etc.), publishing of a full research study can take up to 6 months. The challenge with that is: 1) by the time it is out on the market the findings might already be outdated; 2) people are looking for research at a time when they are looking to make a decision, not when you are ready to release the findings.

Technology buckets. The easiest way for analysts to publish the study (and operations and business planning of their managers) is: 1) identify a topic that matters; 2) make sure that there are enough vendors out there that care about it so that you can monetize it; 3) define a selection criteria and your target vendor list for the study. The problem with this is that many vendors don’t solely fit into one study the way it is defined by analysts. Even if they do, that category might not be big enough to financially make it worth writing a full study around it.

“Smartest guys in the room” syndrome. Being in a position to see years of other people’s hard work materialize into a product and having your opinion about it being heard is a privilege, not an opportunity to build your ego. Humbleness and being an expert are not mutually exclusive, actually humbleness is the key prerequisite for becoming an expert in anything and a trait that is sometimes missing in an analyst industry.

Content formats. It is exciting when months of your hard work pays off, you look at the final version of your study and are ready to let the word know how great it is. The problem with that is your thought process and how to analyze the topic is not necessarily aligned with how people want to learn about it. In addition to being an analyst, you are also in a content marketing business. Every year we learn about drastic changes in the content marketing world (formats, channels, delivery, etc.), but formats for the delivery of analysts findings, with a few exceptions, haven’t changed in decades.

Business model. Obviously, analysts are not in this business just for media mentions, attention and learning, but there are a few areas that should be addressed

- Pay-for-play. Analyst reports should be about insights and educating the market and commissioned research is typically centered around proof points and validation. There are a ton of content factories out there that can validate any vendor’s messaging cheaper and faster, and even put some data behind it. What makes content like this more valuable, if it comes from analyst firms, is credibility, but credibility is hard to maintain in the long run by putting your brand on content that is not very credible.

- Analyst as a Sales Engineer. People are getting more reluctant to accept the requests for research briefings because they expect that there will be a sales pitch somewhere on a call or a few sales reps listening. Research briefings should be just that – research based discussion about a vendor’s solution or strategy and analysts providing feedback where appropriate.

- Clients vs. non-clients There are many deals being won or lost because of a vendor position or (non)inclusion in analyst reports. Vendors are aware that they cannot buy their way into reports, but they are also aware that being a client will not hurt their position.

So what does it take to fix the analyst industry?

Digital Transformation

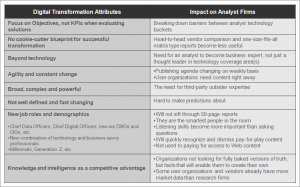

Digital transformation is a result of a perfect storm of new customer requirements, technology advancements, new ways of business and technology leadership and, in general, a new way of doing things as an organization. Key attributes of digital transformation are further exposing some of the shortcomings of an analyst model and, more importantly, making it more difficult to cover this trend by using traditional instruments and practices of the industry.

Becoming a digital enterprise touches all key areas of the business and even though technology does play an integral part, it cannot be the sole enabler of organizations becoming digital businesses. Additionally, digital businesses are changing their processes for evaluating technology solutions and finding ways to use it as a source of competitive advantage and incorporate it in their business strategies.

Digital Transformation, organizationally, could be the most significant trend since the formal IT departments were formed or, technology-wise, since CERN made the Internet generally available in 1993. A movement that extensive and significant requires a radical change in many areas and, therefore, the approach for researching and covering technology markets needs to either fundamentally transform or be replaced with new models.

New Model

Predicting where digital transformation will take enterprises is a difficult task and it is almost as difficult to project what type of analyst model would work best in a digital economy. However, based on what we know now about the strategies of leading organizations that are looking to become digital businesses, a research and publishing model with the following attributes would be a good place to start:

- Technology as a Competitive Advantage (TaCA). Organizations listed using technology as a source of competitive advantage and taking a similar approach when analyzing and evaluating technology solutions resonates well with goals of digital businesses.

- Ongoing research and publishing. Continuous research data collection and publishing makes research more actionable and relevant.

- Business objective based approach. Helping digital businesses connect the dots between value propositions of different technologies and their business objectives.

- Engaging and actionable content formats. Applying best practices for content marketing while keeping research credible.

- Situational analysis. Departure from a one-size-fits all approach and evaluating technology in the context of individual goals of digital businesses.

- Platform vs. know-it-all. Including expertise from 3rd-party sources in the publishing process and using research as a backdrop for facilitating conversations in the industry.

Some favorite messages that analysts like to use are “you need to change or…” and “The XYZ way of doing things is dead”. Ironically, the only industry that didn’t even attempt to change is an analyst’s own, with doing things the same way for over three decades.

People always ask me if digital transformation is really that prevailing, as it is often being portrayed. I will have a better answer to this question when I see what it does to the analyst and market research industry.