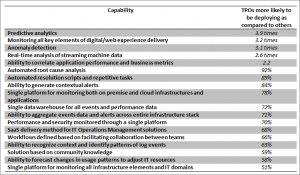

DEJ’s article Key Capabilities of Top Performing Organizations for Managing IT Operations highlights 18 capabilities that enable top performing organizations to outperform their peers in the key areas of managing IT Operations. However, these capabilities are provided by a variety of vendors and many of them are not even competing against each other. These vendors are coming from different technology backgrounds and an analysis of vendor landscape for IT operations brings up several important issues that should be addressed:

1 – Competitive landscapes are defined by a problem that vendors are addressing, not underlining technologies. Analysis of technology vendors that are providing leading capabilities for modern IT Operations shows that these companies built their solutions to effectively address pressing and emerging business problems and are not meant to be the next great solution for technology categories that were defined 5-10 years ago. Therefore, their competitiveness cannot be described in two dimensions and their market leadership (or lack off) can only be defined based on: 1) the importance of problems they are addressing; 2) their effectiveness in addressing these challenges.

2 – The days of 15+ vendors fitting into the same technology bucket are gone. Even grouping vendors in smaller technology buckets – where possible – doesn’t create homogeneous categories, as these solutions are often built on different underlining technologies. Some of the examples include rules and configuration logic vs. machine learning in the IT incident management market or different locations of monitoring points in the Digital Experience Management/Monitoring market (e.g Riverbed’s approach vs. Catchpoint or Dynatrace). That leads to an emergence of micro markets defined by use cases and end-user technology environments.

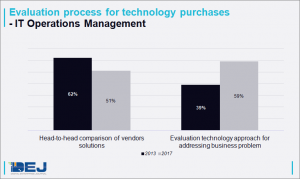

3 – Less head-to-head comparison and more education about approach and benefits. DEJ’s research shows that organizations are 66% more likely to look for information about benefits of a specific technology approach provided by a vendor, as compared to how the vendor’s offerings compare to other solution providers. That is a major difference from 2013 research results and shows that forward thinking organizations are becoming more open to deploying innovative, less mature technology approaches.

4 – Triumph of technology outliers. DEJ’s research shows that capabilities whose deployments are making the biggest difference in performance are provided by vendors that don’t squarely fit into any technology bucket. Offerings of companies such as BigPanda, Nexthink or Indeni are a part of a core IT Operations technology mix of TPOs, but there is no industry accepted technology category that would capture the capabilities of these solutions.

Outlook

1 – Market is coming to emerging vendors. As the increasing complexity of IT Operations is being listed as the number one challenge and the need to become a digital enterprise as the key strategic goal, emerging vendors are well positioned to tackle these challenges. More complexity and new IT architectures are better for these vendors, as their solutions are designed to thrive in dynamic, agile and complex environments. One of the examples include a vendor such as Instana, whose solution is very effective in monitoring service performance in dynamic, container-based architectures.

2 – Fit for Digital Transformation leaders. DEJ’s infographic shows 6 attributes that digital transformation leaders look from technology solutions of any type: 1) Integration ; 2) Intelligence; 3 Automation ; 4) Agility; 5) Collaboration; 6) Flexibility. The findings of DEJ’s study Modernizing IT Operations for Digital Economy show a direct correlation with these attributes and the key requirements for modern IT operations. As organizations are increasingly going through digital transformation while being faced with higher user expectations for performance, capabilities of modern IT operations are becoming the key ingredient of winning digital transformation strategies.

3 – Telling a CIO story. One of the key areas for improvement for some modern IT Operations vendors is being able to show the uniqueness of their approaches without getting too deep into features and functionalities. Even though it is important to explain the “magic” behind their algorithms and processing engines, being able to communicate the value of their solution in a fashion that is clearly aligned with the goals of IT and digital transformation executives – both technology and organizational – remains one of the obstacles for an even faster growth of these markets.

4 – Selection criteria. DEJ’s research shows that ease of use is the key selection criteria for 64% of organizations. Additionally, 61% of organizations reported time to value to be very high on their list of priorities in the selection process. Even though most of modern IT Operations solutions are fairly easy to use, many of them could require months until they start delivering the full value to user organizations.

5 – Beyond monitoring. For many years, the majority of IT Operations management market includes IT monitoring solutions of different flavors – APM, NPM, ITSM, etc. DEJ’s Modernizing IT Operations for Digital Economy shows that “IT Operations management is becoming analytics, data management and an automation business”. Some of the leading modern IT Operations solutions don’t even include traditional monitoring and reporting capabilities. One of the best examples is Turbonomic – a company that enables optimization of resource utilization and application performance in an automated fashion.

Summary

Many modern IT Operations vendors are still taking a traditional approach to positioning and marketing and still searching for a new industry acronym (self or analyst defined) to associate their offerings with. That approach might be effective for larger vendors, but those that don’t have boatloads to spend on marketing should take the same approach to their positioning as they did at building their technology that made them successful: 1) clearly define problems that need to be solved and focus your messaging on them; 2) focus on outcomes, not KPIs.